InvestSuite - Investing in WealthTech as a Service

We are excited to announce that 365.fintech has participated in a late seed round of InvestSuite, an international B2B WealthTech startup. PMV, AB Accelerator and other investors have participated in the €3 million round; bringing total funding of the company to €9 million.

InvestSuite, with HQ in Leuven, Belgium but with a growing international presence in London, Sydney, Warsaw, Copenhagen, Madrid and Amsterdam has already acquired enterprise clients in multiple countries on four continents. Since March the firm has grown from 25 people to 45, recently adding multiple senior hires to further fuel the expansion, as well as expanded its development and quant teams.

The company offers Cloud-native, modular WealthTech and InvestTech solutions to financial institutions all over the world, combining deep quant expertise and banking & investment knowledge with beautiful, intuitive human-centric design, and a comprehensive understanding of how the ‘backend’ of a financial institution works.

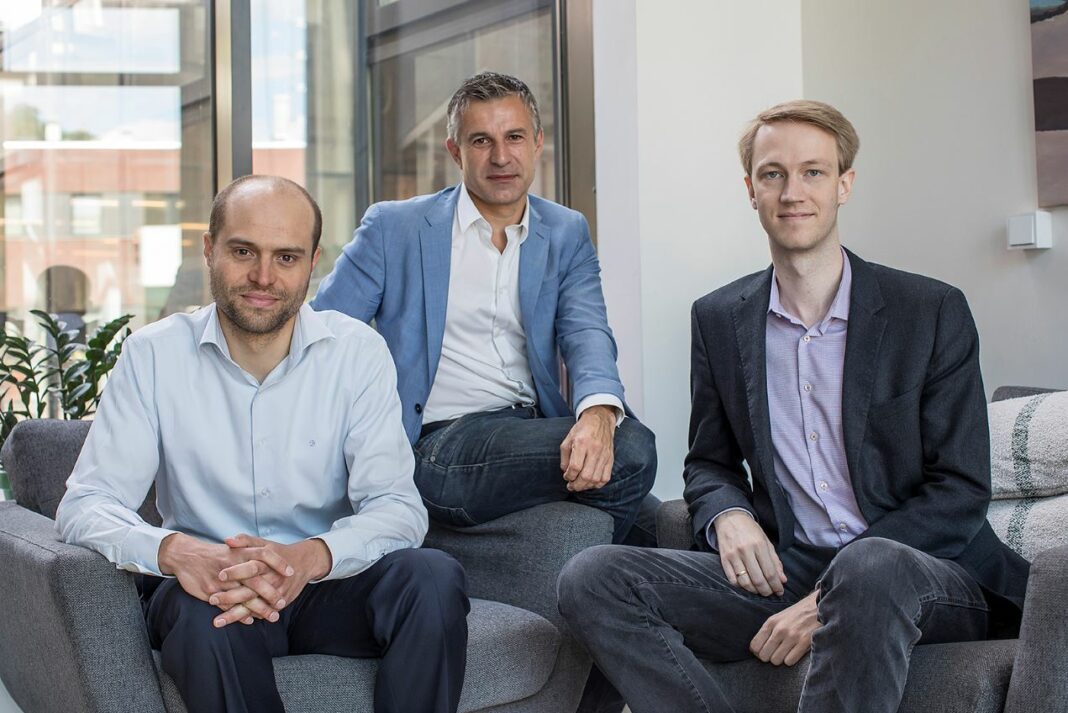

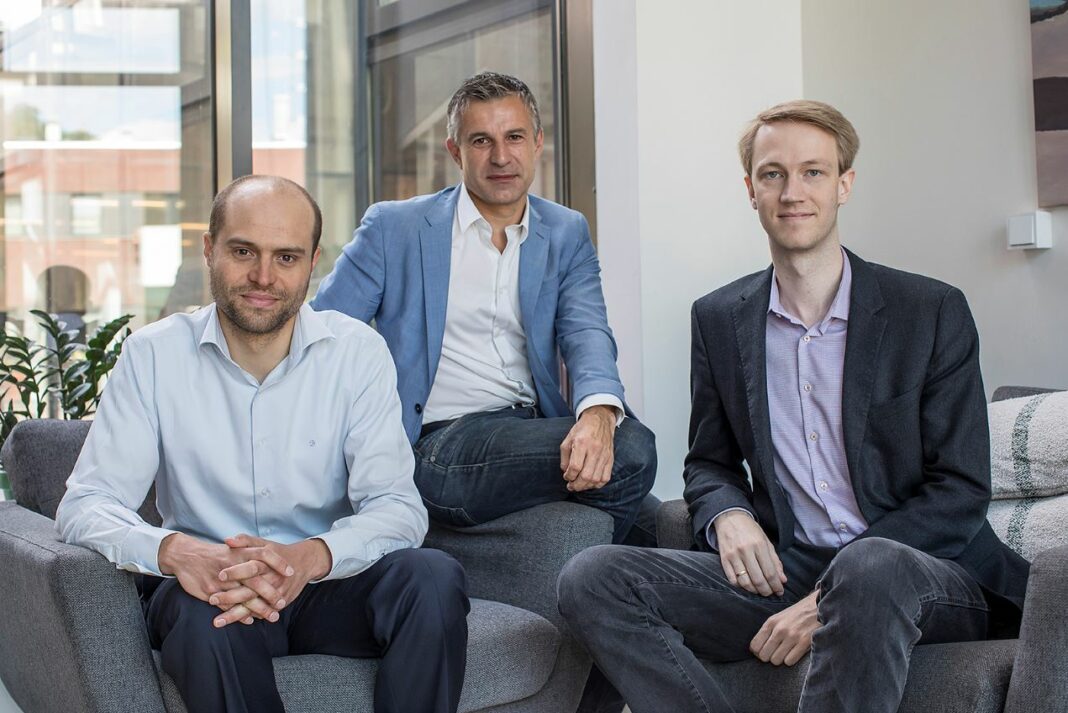

Left to right: Emmanuel Wildiers (Head of Investment Research), Bart Vanhaeren (CEO and co-founder), and Laurent Sorber (CTO and co-founder) source: InvesSuite, eu-startups.com

There are several key reasons why we decided to invest in InvestSuite:

- Strong founding team is a cornerstone consideration of all of our investments and InvestSuite is no exception to this rule. The business is led by CEO and co-founder Bart Vanhaeren, previously board member at KBC Securities. Bart has managed to assemble a very seasoned and focused leadership team across the board - from operations, technology to business development and design.

- Unique wealth-tech differentiator - a suite product strategy: InvestSuite has recognized early on that flexibility and modular approach is key in delivering and implementing their wealth-tech solutions in the broad b2b context. This insight led the team on a journey to develop a unique suite of digital wealth products. From portfolio optimizer, through full-fledged robo-advisory; self-service investment platform to an innovative 'storyteller' product. This highly modular approach is one of the differentiators which will help InvestSuite to succeed.

- Significant market tailwinds: Thirdly, we are convinced InvestSuite is very well positioned to leverage the shift to digital-first wealth management, which is taking place worldwide; even further accelerated by the recent COVID pandemic. Increasingly, the next generation disruptors - such as robo-advisor challengers, fractional stock trading apps and investment platforms, are competing for the customer attention.

This drives the (very) long tail of market players to action as the digital robo-advisory market alone is expected to triple in AUM globally, between 2020 and 2025. With significant distribution and existing customers bases, these incumbents will be heavily incentivized to provide on-par digital experiences to their customers.

We are looking forward to supporting Bart and the team at InvestSuite in disrupting the wealth management space and enabling incumbent financial institutions to serve their clients in radically better way!